SOMERS H. WHITE, CPAE, FIMC

Mergers & Acquisitions

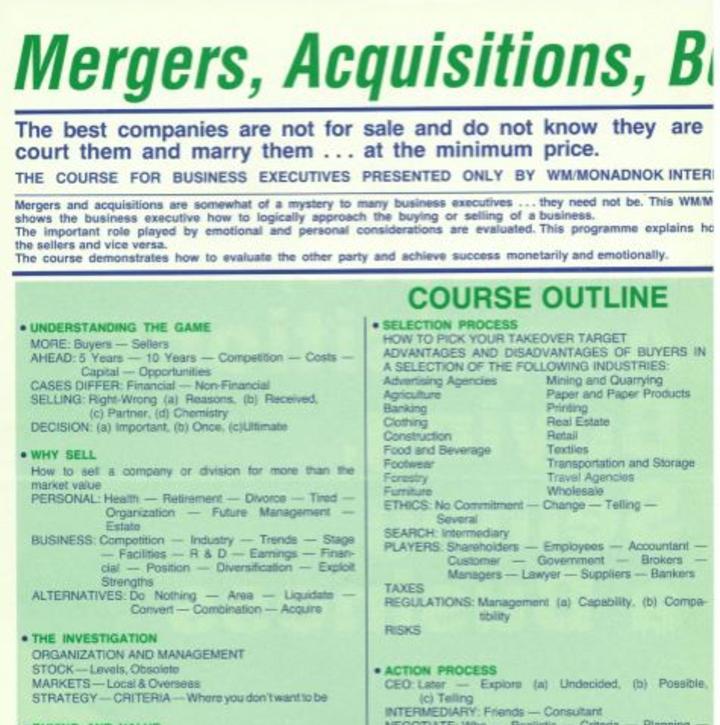

Americans have seen a flurry of mergers and acquisitions of whole businesses as well as the purchase and sale of company subsidiaries and divisions.

The small or medium-sized business person may want to buy or sell a business. In approaching this activity, an individual should have a good overview of what is involved.

It is important during such work that one understand the six major areas:

Where the company is heading;

The target;

Valuation;

Negotiation;

Financing;

Success after the sale has been completed

Somers H. White CPAE, FIMC

In entering the arena of buying or selling a business, the first thing to understand is where the company is heading. The executives need to determine where the company is and where they want to go. However, for certain reasons it may be determined that they just do not have what they need to reach their goals.

So, the conclusion may be to sell the firm because its position is going to deteriorate and will be less valuable in the future.

As you determine your strategy for the future of the company, you may come to the conclusion you want to sell a particular aspect of your business. This may be necessary because this area is not as profitable; it is going downhill or does not fit properly with the core business. You may be able to use the capital more profitably in a better way.

The experience of our management consulting firm has been that those buyers who do the best understand the sellers and those sellers who do the best understand the buyers.

The same kind of approach described above for sellers can also be used for buyers. For example, management starts with a strategy and decides where they want the company to be in five or 10 years.

The conclusion may be that for the length of time and the amount of money that will have to be expanded, it is less expensive to buy another organization. In that particular industry, they need to look at the logical candidates. This brings into consideration the three classic types of acquisitions.

First, there is a horizontal acquisition that is the acquiring of a competitor. This started as far back as the “guild days.”

The vertical acquisition involves purchasing a supplier or customer. For example, in the recent past certain public utilities have purchased coal producing companies. It works the opposite way when purchasing a customer organization. Recently, there have been various wholesalers in the food business who have purchased retailers.

The third type of acquisition is on unrelated businesses, providing diversification so that the company will be less vulnerable to industry swings. This was the classic English holding company that later evolved into what we call the conglomerate.

The new trend is the other way around with management aiming to develop around a core and selling off those product lines that are away from their central business.

This has been part of the very large current wave of buy-outs by management. They are often highly leveraged and are called Leveraged Buy Outs or LBO’s. When management buys out a company, they have more of a vital interest in the profitability of the company.

Because the debt load will be so great, often on the basis of the present business, they cannot meet the interest obligation that will very quickly become due. Often they sell assets or a division to produce immediate cash that can help to meet the interest and to pay down on the principle so that their interest burden is less.

In addition to the meeting of the cash flow crisis, by sale of assets they often cut expenses, frills and turn a company that was marginally profitable into a highly profitable company.

After determining where you want to go, the second step is to determine the target. If you want to buy/sell, which companies meet your criteria. If you are selling a business, who are the companies with whom your organization would best fit and therefore could pay the highest price.

The third area is valuation. This means determining what the business is worth. There are many different ways to do this. Often it is related to the earning capacity of the business. You can do a comparative analysis to find out what similar size businesses have sold.

The fourth consideration is negotiating the deal. The initial contact, if incorrectly handled, can set in motion the failure of the consummation of a deal down the line. It has been my experience that when a seller wants to sell to a particular buyer and a buyer wants to buy, the can probably make a deal.

You should consider carefully who will negotiate, how they will negotiate, and the role that lawyers, accountants, investment bankers and others will play in the procedure. Eventually, it all comes down to a written document called a memorandum of understanding.

The fifth aspect is financing. The deal can fail to materialize because the financing cannot be obtained. If you are selling, you do not want to spend a great deal of time and emotional energy only to find out the organization cannot come up with the money.

The sixth and final aspect is making the deal a success after the sale is completed. Many people think of the purchase as the end, but it’s only the beginning.

Experts have estimated that four out of five acquisitions/mergers of companies do not work out successfully. Once you are in the deal, how do you get out?

Many novices think the purchase/sale of a company is 95% financial and 5% psychological. Many of those who have been in the field for a long time feel the ratio is reversed, being 5% financial and 95% psychological.

If you are a seller there may be certain considerations that may be important to you.

For example, because your name is associated with a company you want it to do well. You want the quality of the company to continue so there is no embarrassment to you.

In spite of their long and faithful service, employees you thought were going to be treated well, are not. If there is a pay out over time, you may receive the money you are supposed

Many novices think the purchase/sale of a company is 95% financial and 5% psychological. Many of those who have been in the field for a long time feel the ratio is reversed, being 5% financial and 95% psychological.

to receive. You may have not anticipated the problems or broken promises.

If you plan to stay with a company after it is acquired, you may find that there is a clash with your value system or the controls on you are unbearable.

Business Purchase Price Cut 50% at the Negotiating Table

Two brothers owned 1/3 of a business in which they were the President, Vice President and two other families of relatives also owned the balance of the stock, but none were active in the business.

After two years of legal hassles, the heirs and the two brothers were ready to sign the papers for 19.2 Million for the remainder of the business. The real estate was handled separately. The signing date was set.

The brothers asked Somers White for an analysis. After giving his evaluation, they retained Somers for an additional assignment: Negotiating. He arrived at the meeting of the lawyers representing the brothers and two sets of heirs and went through a step-by-step analysis, showing all alternatives and why, if the business was not run by the two brothers, the business would only be worth $6.4 Million.

The President of the company became overanxious and ended up making the deal at $9.2 Million but it was still attractive because he was originally going to pay 100% more.

If the brothers had made the deal at $19.2 Million, they would not have had money for the working capital and the company might well have gone into bankruptcy in a short period. With the assistance of people who know about Mergers and Acquisitions, the price received or paid can be greatly changed.

There are no hard and fast rules in the game of acquisition and sales of companies. Each deal is different because of the people, conditions, markets and finances are all different But the one thing is for certain, they buying and selling of businesses and divisions will undoubtedly continue to be a significant activity in the US., and throughout the world.__________

Somers White is the president of the management consulting firm, Somers White Company. He assists clients who wish to purchase or sell their companies, and is available for sales, management and negotiating meetings for in-company and trade associations. He may be reached at Somers White Company

4432 East Camelback Road #121 Phoenix, Arizona 85018

Telephone: 602-952-9292

Email: somers@somerswhite.com

Somers White Says:

“When you are selling, the water on the property is a lake. When you are buying, it is a pond.”

SOMERS H. WHITE, CPAE, FIMC